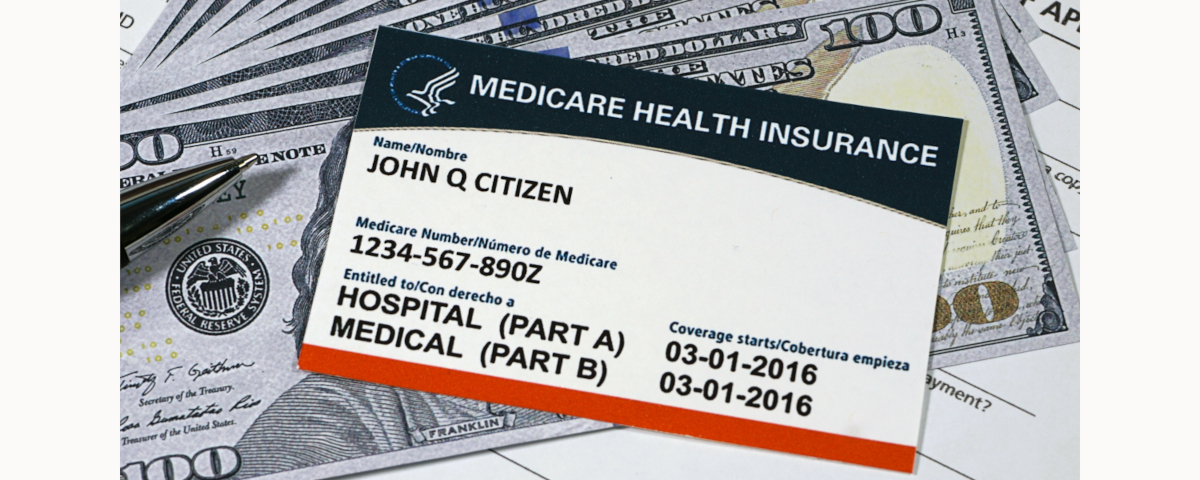

Safeguard Your Medicare Number: A Guide to Avoiding Fraud and Protecting Your Benefits

Medicare numbers are our gateway to vital healthcare services. But just like your Social Security number, they're confidential and require us to protect them since fraudsters are always seeking ways to exploit this information. So, it's important to be informed and vigilant in safeguarding your Medicare number.

Why Your Medicare Number Matters

Sharing your Medicare number carelessly can lead to several problems that can cause much more than just a headache:

- Identity Theft: A stolen number can be used to submit fake medical bills in your name, drain your Medicare benefits, and potentially harm your credit score.

- Scams: Beware of unsolicited calls, emails, or visits from people claiming to represent Medicare. Legitimate organizations won't pressure you to share your number over the phone. If you're unsure, hang up and find the verified contact information yourself.

Common Medicare Scams to Watch Out For

The Social Security Administration shows that Medicare fraud can cost Americans more than $60 billion a year. Some experts proclaim that the number may exceed $100 billion.

Medicare fraud ranges from relatively simple schemes to complex, highly organized crime rings. Here are the two most common forms of fraud beneficiaries are likely to face:

- Fake Equipment Bills: Scammers might offer "free" medical equipment and then bill Medicare for unnecessary items in your name.

- Phony Doctor Visits: They could fabricate doctor visits and bill Medicare for services you never received.

Sharing your number could also allow someone to:

- Change Your Plan: Without your knowledge, they might switch you to a Medicare plan with different benefits or higher costs.

- Limit Your Care: They could even restrict your access to specific doctors or specialists within your plan.

Protecting Your Medicare Number

Just like social security numbers, there are a few steps you can take to ensure your Medicare number remains safe:

- Be Cautious: Only provide or share your number with trusted sources like your doctor's office or a verified Medicare representative.

- Review Your Medicare Statements: Look for suspicious charges or services you never received.

- Shred Old Documents: Destroy any documents containing your Medicare number before throwing them away.

What to Do If You Suspect Fraud

If you suspect someone is using your Medicare number illegally, contact Medicare directly at 1-800-MEDICARE (1-800-633-4227) or visit their website at https://www.medicare.gov/.

By staying informed and following these tips, you can protect your Medicare number, your benefits, and your peace of mind.

Featured Blogs

- Your College Student Is Off to School—Is Their Stuff Covered?

- Home Renovation? Here's When to Notify Your Insurance Agent

- Does Your Car Insurance Cover Riots, Vandalism, or Civil Unrest?

- Will Insurance Cover a Contractor or Handyman Injury on Your Property

- How to Obtain an International Driving License and Why You Might Need One

- What Is PIP Insurance—and Why It Matters to You

- Are E-Bikes Considered Motorized Vehicles for Insurance or Registration?

- When the Wind Blows: What Happens If Your Tree Falls on a Neighbor’s House?

- Boat Insurance Basics: Why Proper Coverage Is a Must for Every Boat Owner

- Understanding Roadside Assistance: Is It Worth the Extra Premium?

- Carpooling to Sports Events this Summer? Make Sure Your Insurance is on Board

- Power Outage Playbook: What Your Insurance Might

- Big Brother in the Dashboard: The Truth about Telematics Devices

- Hidden Protection: Homeowners Coverage You May Not Know You Need

- Protecting Your Furry Friend and Your Wallet

- Top 5 Common Insurance Myths and the Truth Behind Them

- The Importance of Comprehensive Coverage: What It Is and Why You Might Need It

- Breaking Down Home, Auto, and Life Coverage

- Understanding Your Insurance Options

- What Factors Impact Your Auto Insurance Premium?

- Questions to Ask Before Choosing an Insurance Policy

- Does Your Policy Cover Winter Storms? Understanding Your Property Insurance in Extreme Weather

- Why Insurance Should Be Part of Your 2025 Resolutions

- New Year, New Home? Essential Insurance Tips for First-Time Homebuyers in 2025

- Smart Ways to Cut Insurance Costs without Sacrificing Protection

- Year-End Insurance Checklist: Ensure You're Covered for the Year Ahead

- The Tail Wagging Truth: Unpacking the Value of Pet Insurance for Your Furry Friends

- Why Choosing an Independent Insurance Agent Could Be Your Best Decision Yet

- Autonomous Vehicles and Insurance: Adapting Policies for the Future of Driving

- The Critical Role of Life Insurance in a Comprehensive Personal Finance Strategy

- Protect Your Castle: Essential Tips for First-Time Homebuyers on Choosing Home Insurance

- Flu Season Survival Guide

- How to Create a Home Inventory for Insurance Claims

- Brown and White Eggs: What’s the Difference?

- DIY Disaster Preparedness Kit: Make your own disaster preparedness kit with these essentials to keep your property and family safe

- Understanding the Different Types of Property Insurance Coverage: Are You Fully Protected?

- The Benefits of Bundling: How Combining Policies Can Save You Money

- Is there such thing as Hurricane Insurance?

- The Impact of New Technology on Insurance

- Why Property Insurance Isn't Enough: Essential Property Preparedness Tips Every Homeowner Should Know

- Protecting Your Investments: The Role of Insurance in Wealth Management

- Rising Temperatures, Rising Risks: How Climate Change Affects Property Insurance

- Insurance Myth Busters: Debunking Common Misconceptions about Coverage

- Pool and Liability Insurance: Staying Safe and Protected around the Water

- The Evolution of Insurance: Trends and Innovations Shaping the Industry

- Fire Safety Awareness: Mitigating Risks and Ensuring Adequate Coverage

- The Future of Work

- Emergency Preparedness: How Insurance Can Provide Peace of Mind During Crises

- Scenarios that can lead to a voided Property Insurance policy

- Navigating Insurance Renewals: Tips for Reviewing Your Policies

- Summer Safety Tips: Protecting Your Property and Liability Risks

- Easy & Creative Ideas to Refresh Your Home for Summer

- Revamping Your Home? You May Need to Revamp Your Coverage

- How Milestones Can Affect Your Coverage Needs

- Safeguard Your Medicare Number: A Guide to Avoiding Fraud and Protecting Your Benefits

- Thinking of Renting Out Your Property? Consider These Liability Risks First

- How to Fall Back Asleep After Waking in the Middle of the Night

- Demystifying Mortgage Rates

- How to Improve the Air Quality in Your Home

- Should I Buy a Second Home?

- The Rise of Urban Gardening

- Tech-Enhanced Property Preparedness

- Fueling Your Mind with Brain-Boosting Foods

- Protecting Your Family's Financial Future

- Embracing Our Roles: Renewing Our Commitment to Sustainable Living

- Tips for a Stress-Free Tax Season Experience

- Inspirational women who make the world a better place

- Spring Forward: Adjusting Your Routine for Daylight Saving Time

- Gratitude - Key to a Positive Mindset

- Smart Home Technology: How it Affects Your Property Insurance

- 3 Common Sense Things People Should Know

- The Rise of Eco-Friendly Homes: Sustainable Property Trends

- Unraveling the Mystery of the Extra Day

- Buying Your First Home? Tips and Insurance Considerations

- Financial Fitness in 2024: Budgeting and Saving Tips

- New Year's Resolutions: Staying Committed Year Round

- The Magic of Christmas Traditions

- How to be a Time Management Whiz During this Busy Season

- How to stay organized during the holidays

- Mastering the Mind: Techniques for Better Memory and Cognitive Function

- The Art of Productive Procrastination: How to Make the Most of Downtime

- Managing Home Maintenance: Year-Round Checklists for a Well-Maintained Property

- How to enjoy and celebrate chilly, gloomy days

- Is Owning Your Home in Retirement Wise? Exploring the Pros and Cons

- Best Dog Breeds that Suit Your Needs

- DIY Delights: Creative Projects for Seniors

- Coping with Seasonal Affective Disorder (SAD)

- How to Trim Down Hidden Costs of Flying

- How to Experience Positive Aging (8 Tips)

- Retirement: How to Handle the First Year

- How much should you actually have in savings?

- When travel insurance can go wrong

- How to Build Sustainable Wealth

- Enhancing Resilience as We Age

- Tips to Consider when Selecting a Contractor

- The best herbs to grow for beginners

- Is celebrating your 100th birthday no longer a dream?

- Summer Workouts for Your Dose of Vitamin D

- Do I Need a Financial Advisor?

- Music and Your Wellbeing

- How to Dispose of Unused Medications

- Aging and Our Body’s Ability to Heal Itself

- What is Credit Health Insurance? (Copy1)

- What is Credit Health Insurance? (Copy)

- What is Credit Health Insurance?

- Waking Up to the Impact of Insomnia

- Electric Car: To Buy or to Lease?

- What experts say about raising the retirement age

- Sharing the Road with Cyclists

- Does Uber Insurance Cover Passengers?

- Living Your Best Life After 60

- Self-Love Ideas for Valentine’s Day

- Life Without Clutter

- When to Upgrade Your Auto Insurance

- Winter Hydration – Do I Need It?

- What Does My Home Insurance Policy Cover?

- Why Do I Keep Breaking My New Year's Resolutions?

- Closing Out the Year with a Smile!